As for the ability to pay interest and wholesale sales, impact on the performance on the book value ratio per share. The results of the study showed that Sales period Average repayment period and the ratio of total assets to equity the impact on the operating results to the earnings per share ratio has a significant relationship. And to analyze for correlation and multiple regression analysis. This research aimed to study the factors affecting the performance of the listed companies in the consumer goods industry in the fashion category by studying the secondary data from the financial statements of the year 2015-2019 of 19 companies listed on the Stock Exchange of Thailand.

#Fixed asset turnover ratio pdf how to#

Now, check your understanding of how to calculate the Asset Turnover ratio.Faculty of Business Administration and Information Technology, Rajamangala University of Technology Suvarnabhumi, Suphanburi Campus.įaculty of Business Administration and Information Technology, Rajamangala University of Technology Suvarnabhumi, Suphanburi Campus Many other factors (such as seasonality) can also affect a company’s asset turnover ratio during interim periods (such as comparing quarterly results of a retailer).

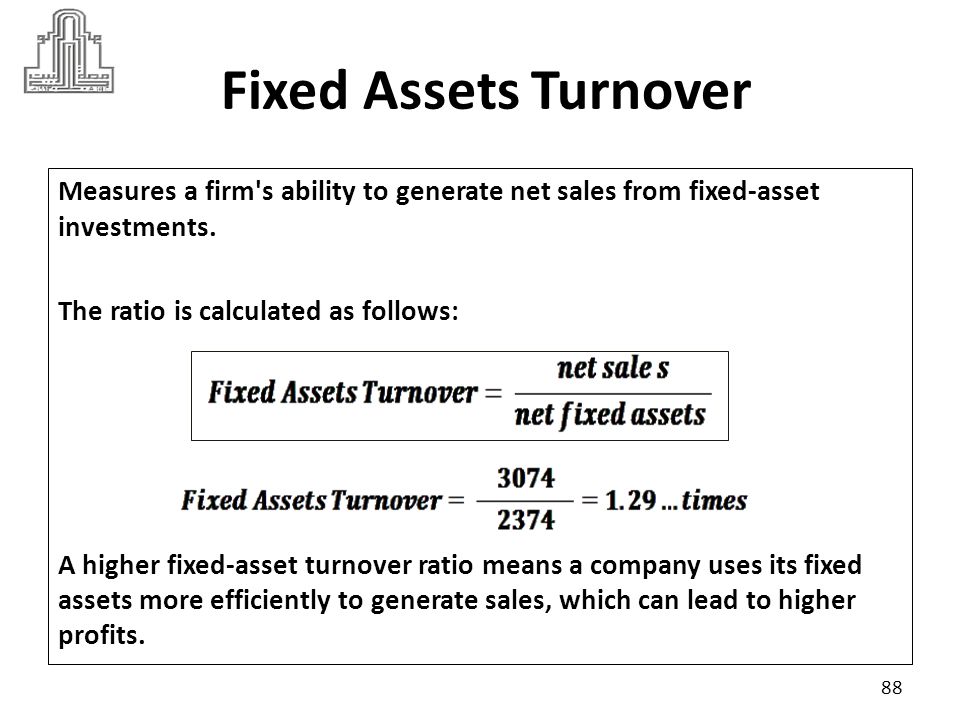

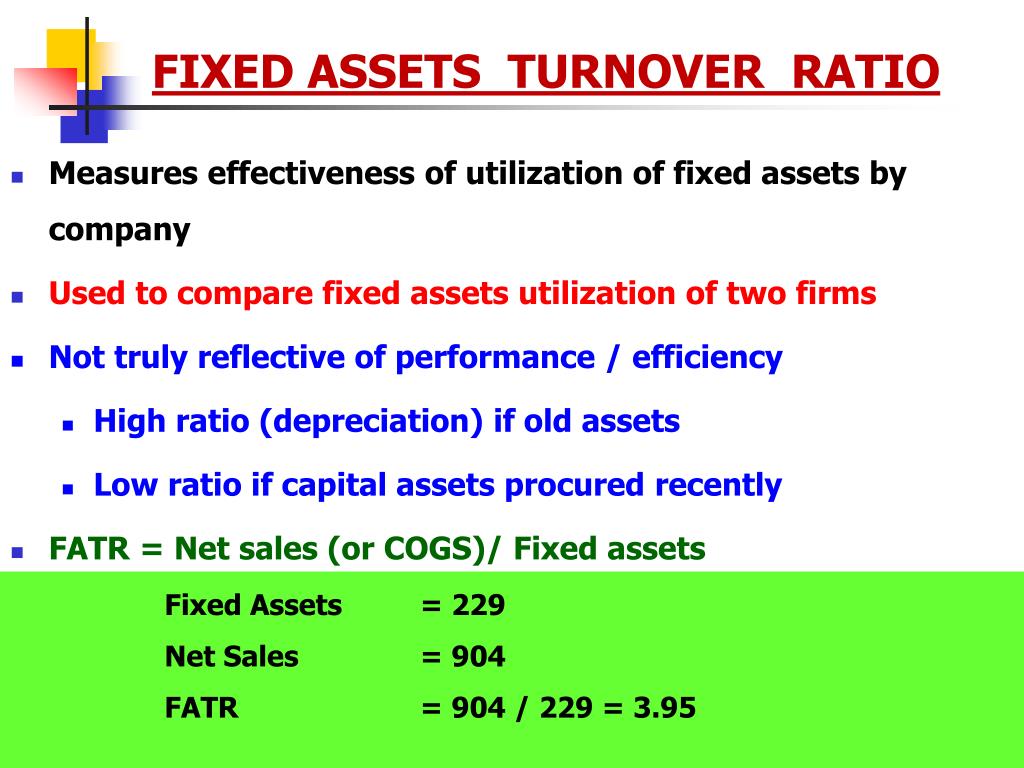

Likewise, selling off assets to prepare for declining growth will artificially inflate the ratio. The asset turnover ratio may be artificially deflated when a company makes large asset purchases in anticipation of higher growth. The asset turnover ratio should be used to compare stocks that are similar and should be used in trend analysis to determine whether asset usage is improving or deteriorating. A higher fixed asset turnover ratio indicates that a company has more effectively utilized its investment in fixed assets to generate revenue. The fixed asset balance is used net of accumulated depreciation. This efficiency ratio compares net sales (income statement) to fixed assets (balance sheet) and measures a company’s ability to generate net sales from property, plant, and equipment (PP&E). The fixed asset turnover ratio (FAT) is, in general, used by analysts to measure operating performance. While the asset turnover ratio considers average total assets in the denominator, the fixed asset turnover ratio looks at only fixed assets.

In these cases, the analyst can use specific ratios, such as the fixed-asset turnover ratio or the working capital ratio to calculate the efficiency of these asset classes. Sometimes, investors and analysts are more interested in measuring how quickly a company turns its fixed assets or current assets into sales. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales. The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. The goal of owning the assets is to generate revenue that ultimately results in cash flow and profit. This ratio looks at the value of most of a company’s assets and how well they are leveraged to produce sales. Sales of $994,000 divided by average total assets of $1,894,000 comes to 52.5%. In this case, we’ll reduce total assets by long-term investments. Subcategory, Property, plant and equipment: For the Years Ended Decemand 2018 Description

0 kommentar(er)

0 kommentar(er)